EMV in the Forecourt Compliance Deadline

|

“Businesses will begin experiencing what’s known as ‘fraud migration,’” says Witkemper. “Much like a virus, criminals need to find a welcoming host. Non-compliant fuel dispensers are what they’re looking for.” Unfortunately, it’s easy for criminals to spot dispensers with weak security – even from the street. Old vertical card readers are dead giveaways for unprotected pumps, inviting the fraudster to set up shop. Once upgraded, fuel dispensers feature horizontal, EMV-ready readers, rendering most fraudulent magstripe cards useless – and thus, preventing chargebacks. The Good News It’s not too late, and there is protection available while you wait for installation. Enabling zip code verification can help stave off some criminals trying to use counterfeit credit cards at the pump. Another option is fraud detection programs. Right now, Visa is offering a free year of its Transaction Advisor service to sites that are in the process of upgrading EMV. The service uses an algorithm that attempts to identify risky transactions and force those customers to go inside the store. Obviously, this isn’t ideal. As we all know, there’s nothing customers (criminals included) hate more than having to go inside the store to pay. The Bottom Line While the deadline may have passed, the urgency has never been higher to start your EMV upgrade process. Getting started today is imperative, because that storm of chargebacks gains steam, the line for available technicians will grow even longer. |

Skip the Chip? 3 Consequences to Ignoring EMV

The calm before the storm. That’s what you’re feeling right now if you’re a retailer without an EMV-compliant forecourt. That’s because the flood of chargebacks is on the horizon and rising fast.

|

1. The Chargebacks Are Coming

“It takes 30 to 45 days for chargebacks to start showing up on retailers’ statements,” says Gilbarco’s Payment Marketing Director, Dan Witkemper. “So those who haven’t upgraded should review their network reconciliation statements to see how much they were impacted by counterfeit fraud chargebacks in the next few weeks.” Why the time lag? First, the credit card user must recognize the fraud and report it. Once investigated, retailers will get notified of the chargeback. While that process takes place, your unprotected pumps continue to rack up more fines, creating a vicious, business-killing cycle of fraud. |

2. But Wait, More Fees!

Chargebacks aren't the only costs unprotected retailers will feel. Some major oil brands aren’t willing to risk their reputations on sites that won’t protect their customers. In response, they are instating monthly fees for any site without chip card readers on the forecourt. The takeaway here is, ignoring global payment standards will cost you – one way or another, and soon. On top of all that, there’s a reputation problem to consider. “Running an unprotected forecourt is like running an online store that gets hacked. Consumers are making the choice to purchase fuel from locations where chip cards are accepted.” Witkemper says. “Sites that are unable accept EMV at the dispenser may begin to see their monthly fuel volumes drop.” |

3. Becoming a Target

Maybe your station never gets hit with fraud, but that’s about to change for many retailers. Without EMV protection on the forecourt, retailers are effectively putting targets on their own backs as identity fraud factories. |

Non-compliant Retailers Face New Pressure to Begin Upgrade Process

The April 2021 EMV deadline for gas station forecourts in the United States is staying put, according to a new report from NACS. Forget the hopes and rumors that the deadline would get delayed again. For retailers who haven’t started their upgrade, that means their safety net is going away - very soon.

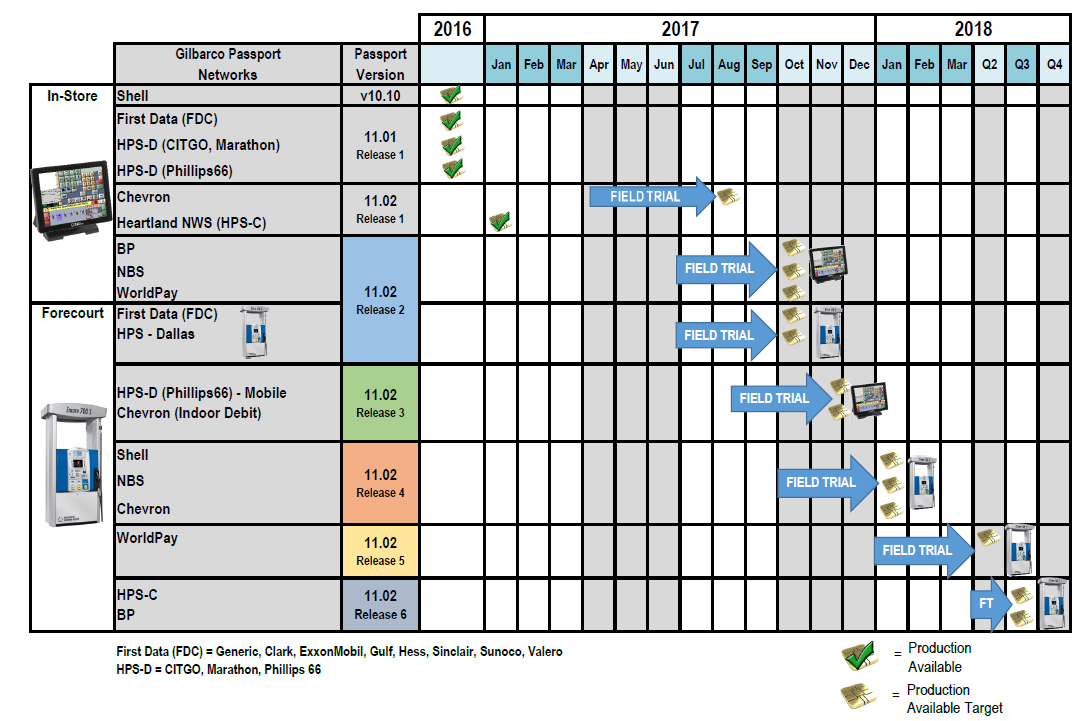

Hafer Equipment is proud to partner with Gilbarco, the first to offer a full EMV solution for gas stations. We can help retailers get started and make up for lost time. 95% of the Passport™ Point-of-Sale installed base is outdoor EMV-ready with 10 million chip card transactions completed and counting. The longer retailers wait, the greater the chance that they’ll miss the deadline - and face the financial risks of the liability shift.

Hafer Equipment is proud to partner with Gilbarco, the first to offer a full EMV solution for gas stations. We can help retailers get started and make up for lost time. 95% of the Passport™ Point-of-Sale installed base is outdoor EMV-ready with 10 million chip card transactions completed and counting. The longer retailers wait, the greater the chance that they’ll miss the deadline - and face the financial risks of the liability shift.

What It Means for Retailers

If your dispensers are still not EMV-compliant by next October and you ring up a sale with a counterfeit card, all the liability for the losses from counterfeit card fraud shifts from the bank to you. You’ll get a chargeback for the entire loss. In 2021, Connexxus projects non-compliant stores will get hit with nearly $13,000 in liability per store and that number is projected to increase to more than $31,000 in 2022. No retailer wants to be hit by that liability shift.

Fraud Migration

As more sites get upgraded to EMV readers, criminals will focus their attacks on the shrinking number of unsecured sites. This is commonly known as fraud migration. So if you’re one of the last sites to upgrade — or don’t upgrade at all — you’ll have limited options: make customers pay inside the store on a POS terminal; become a cash-only business; or take your chances and hope you don’t get hit by fraud, chargebacks and fees. All of these scenarios are business-killers that retailers can’t afford.

Breaking Cost Barriers

We know that the biggest barrier to EMV compliance is cost, particularly for retailers with 25 or fewer sites that may not be able to make upfront investments easily. That’s why we encourage you to talk to our experts about your options. Our team can offer great advice and recommend the right suite of products to make you compliant now and into the future. In addition, our staff can also explain a range of payment and financing options that fit your individual situation. Bottom line, the news means retailers need to take the EMV deadline seriously and act now, like their business depends on it - because it does.

|

Ready to maximize your c-store’s potential? The Passport® Point Of Sale system provides you with the tools you need to grow, control, and track your business. With the richest third-party interfaces on the market, an easy-to-use touch screen, accurate reporting features and reliable service, you can stay on top of your c-store POS transactions while being guaranteed expert support if you need it.

Unique Features & Benefits Include: |

|

|

|

|

|

|

|